Navigating the Markets: Oct 30-Nov 3

- Markets & Mayhem

- Oct 29, 2023

- 3 min read

Welcome to this week's Navigating the Markets. I've optimized the format for brevity as I want to be mindful of everyone's time and focus on the most important elements for traders.

Markets & Mayhem

Last week we saw the most aggressive new lows vs new highs print on the NASDAQ since September of last year, marking a breakdown that is beginning to accelerate underneath the surface of the tech-heavy index.

But the market is not yet oversold, per NAMO, suggesting that we have yet to see true exhaustion.

The relationship between the price of the 10-year note and the NASDAQ composite, which has been increasingly correlated of late, suggests that price may have farther to fall from here as equity risk premiums are extremely low.

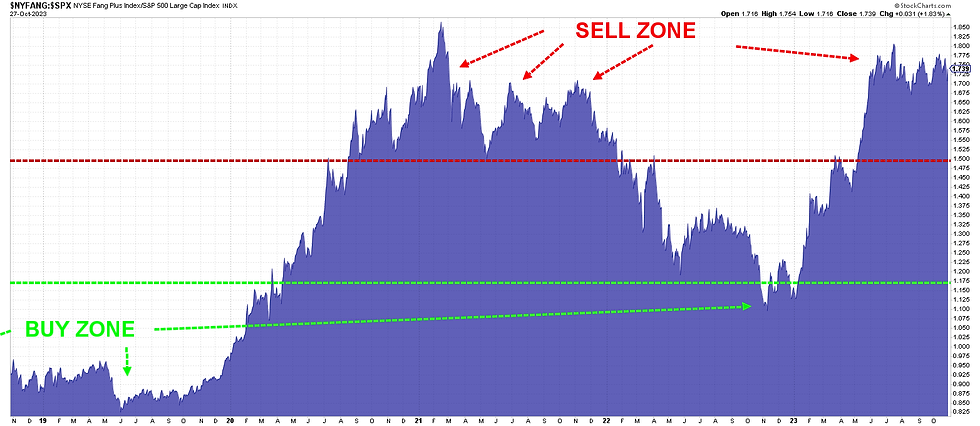

Similarly, the mega cap tech vs S&P 500 ratio suggests we're still well within the sell zone. There could be pair trades to put on here, such as long S&P 500 and fading the mega cap tech for those so inclined. At the very least it's also a reasonably good place to consider lightening up on the most concentrated space: the so-called Magnificent Seven.

.png)