Breakfast Bites - Tue Jul 25, 2023

- Jul 25, 2023

- 2 min read

Rise and shine everyone.

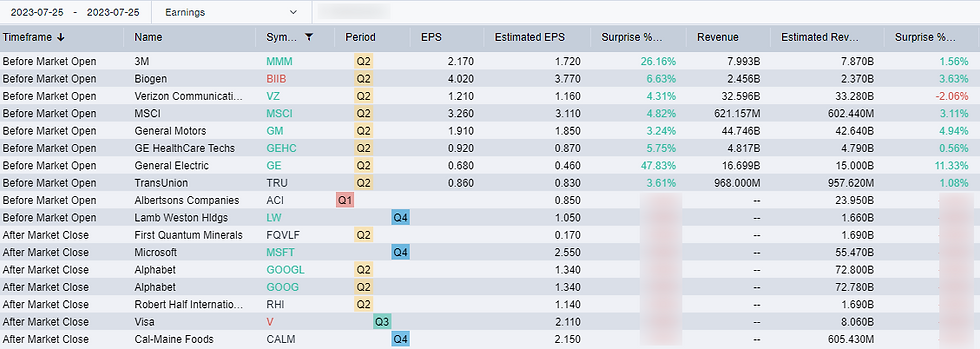

We have a busy day for earnings today with Verizon, GM, Raytheon & 3M reporting before market open and Microsoft, Google and Visa reporting after market close.

We also have the S&P Case-Shiller Home Price Index on the economic calendar.

US Equities are trading higher again this morning. Treasury Yields on the long end are seeing a lift with the Yield Curve steepening slightly to -0.98%. The US Dollar Index is marginally stronger, Oil, Gold and Bitcoin large flat. Agriculture futures are seeing a marginal pullback.

Asia and Australia

Asian equities ended mostly higher Tuesday. Hang Seng led the region as investors reacted positively to Beijing's latest support signals, mainland stocks also higher.

Greater China equity markets rebounded significantly Tuesday, recovering from multi-month lows reached on Monday. The Hang Seng gained 4.1% and the Shenzen Index up 2.5%. Traders focused on politburo officials' pledge to ramp up policy support by boosting consumer demand, giving greater help for property sector.

South Korea GDP slightly ahead of expectations, but details soft. GDP expanded 0.6% QoQ in Q2, compared to consensus 0.5% and follows 0.3% in the previous quarter. However, private consumption and gross fixed capital formation were both negative.

Sri Lanka rupee sinks as interest rate cuts, loosening of import controls weigh

Cereal shortages may fuel inflation in India as rice, corn and wheat prices rise substantially

Europe, Middle East, Africa

European equity markets mostly higher.

The German Ifo business climate survey for July sees further deterioration to 87.3 versus consensus 88.0 and prior 88.5.

Most recent ECB bank lending survey showed record drop in company loan demand to all-time low since start of survey in 2003. Credit conditions tightened more than expected in Q2.

The BoE quarterly update on its Asset Purchase Facility (APF) projected a net loss of ~£100B by 2033 based on prevailing market rate path.

UK pledges crackdown on harmful ads on Google and other web platforms

The Americas

Growing US labor supply helping to limit wage growth, making it easier for Fed to achieve soft landing

JPMorgan's Kolanovic sticks with bearish call on US stocks, citing weak breadth and lagged effect of policy tightening

General Motors reports Q2 EPS beat $1.91 ex-items vs FactSet $1.86; Revenue beat $44.75B vs FactSet $42.13B; Raises Net Income forecast by close to $1B.

Verizon Communications reports Q2 EPS beat $1.21 ex-items vs FactSet $1.17; Revenue miss $32.6B vs FactSet $33.30B

Calendars

(news taken from Reuters, FT, Bloomberg; Calendar from Benzinga Pro)

.png)

Comments