Traderade Ideas: Three ETFs for Hedging

- Nov 21, 2022

- 3 min read

In an environment of increasing uncertainty, it can be helpful to have options to hedge against various macro themes that could otherwise harm returns. Today Ayesha and I want to introduce three ETFs that could be helpful for portfolio hedging.

Rising rates

As long as the Fed is raising rates and running down their balance sheet, there's the potential for further downside pressure against a variety of asset classes, particularly equities, bonds, and real estate.

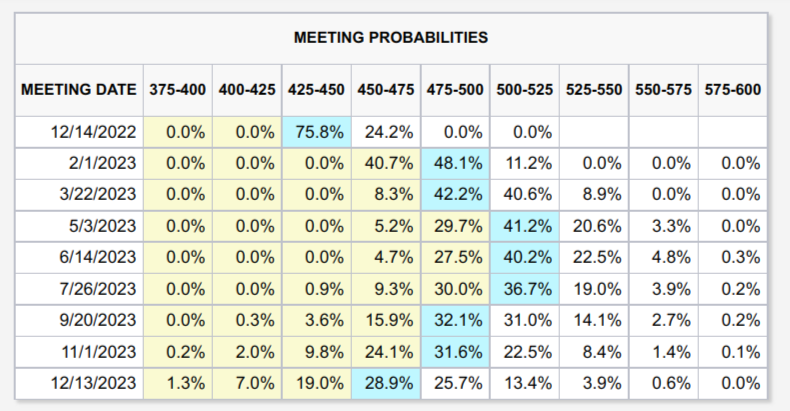

The Fed's terminal rate is currently priced in as high as 5.25% during 2023, before we may see a pause and possibly some cuts later in the year. Between rising rates and quantitative tightening, it is likely that we see additional upward pressure in rates elsewhere.

Because there's a reasonably high inverse correlation between interest rates and equities in 2022, rising rates could continue to exert negative pressure on stock prices. As a result, rate hedges may be appropriate to consider.

.png)